The EB-5 Immigrant Investor Visa program is one of the most exciting programs currently available to foreign investors looking to establish permanent residency in the US.

Each year, the United States Citizenship and Immigration Services (USCIS) sets aside 10,000 EB-5 visas for qualified applicants. Through this program, foreign investors are offered an expeditious path to permanent residency, by making a capital investment of a minimum of $500,000 or $1,000,000 or more, in a new commercial enterprise. For the purposes of the program, a company formed after November 29, 1990, qualifies as a new commercial enterprise, thereby allowing investments in existing businesses incorporated after this date.

Overview

The goal of the EB-5 program is to encourage foreign investment in the US economy by offering foreign entrepreneurs and their families a quick path to permanent US residency. While the program is continuously evolving to better meet the needs of potential investors, here is a brief overview of the program today:

? Personal investment of at least $500,000 in a new commercial enterprise located in areas designated as targeted employment area (“TEA”), which are either rural or with a high unemployment rate, compared to the national average in the U.S., or;

? Personal investment of US $ 1,000,000 in a new commercial enterprise located in any area.

? Upon approval of the Investor EB-5 Visa, he or she will receive a two-year conditional permanent residency visa (green card) with which he or she can live, work, and study freely within the US. The investor’s spouse and unmarried children under the age 21, are all eligible to obtain these visa benefits under a single investment.

? Within 90 days of the two years anniversary of the investor’s entry to the U.S. with their conditional permanent residency, the Investor must apply for the removal of the conditions of their conditional permanent residency with a request that it be made permanent.

? The Investor and his or her family may be eligible to apply for U.S citizenship after 5 years from the date they entered the U.S. on their conditional permanent residency visa.

? There are no language or educational requirements attached to this program.

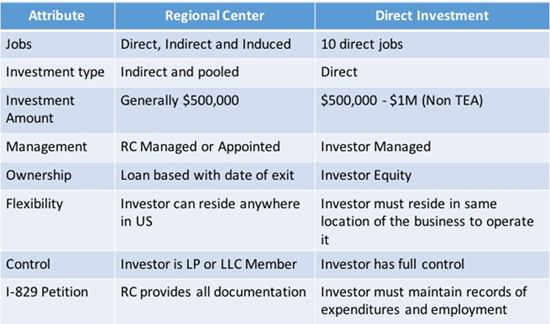

Types of Investments - Direct and Indirect

There are two types of investments that a foreign investor can choose from, under the EB-5 program:

i) a direct investment in a new commercial enterprise; or

ii) an indirect/managed investment through a Regional Center.

1. Direct investment – Under the direct investment, a foreign investor can i) start his/her own new commercial enterprise; or ii) invest in a new commercial enterprise owned by a third person.

In order to apply for his or her EB-5 visa through the direct investment, the Investor must:

? Make a capital investment of $500,000 or $1,000,000 in a new US commercial enterprise, depending on the location that the project will be located;

? Demonstrate that the funds of his or her investment comes from a lawful source;

? Have the funds under the complete control of the Investor;

? Invest all of their funds in the enterprise or be in the process of investing their funds;

? Create at least ten (10) jobs either directly, within 24 – 30 months, counted from the date of filing their visa petition;

? Submit an EB-5 compliant 5 year business plan that demonstrates the business will create the necessary jobs within the allowable timeline under the EB-5 program;

? Hold a policy-making position with the business;

? Demonstrate his or her active participation in the business in the day-to-day operations.

2. Indirect Investment – Under an indirect investment or the Regional Center Program, a foreign investor will make a managed investment through a designated Regional Center, which is a federally accredited entity with the purpose of promoting economic growth in a designated geographic area through foreign investment.

In order to apply for his or her EB-5 visa through the Regional Center Program, the Investor must:

? Make a capital investment of $500,000 in a new commercial enterprise, sponsored by a Regional Center;

? Demonstrate that the funds of his or her investment comes from a lawful source;

? Have the funds under the complete control of the chosen federally accredited Regional Center, which will define the investment project that will facilitate the creation of at least ten (10) direct, indirect or induced jobs, as demonstrated by reasonable economic methodologies, within 24 – 30 months, from the date of filing their visa petition.

? Investors involvement in the business is limited to the responsibilities of a limited partner or limited member of the entity that is the new commercial enterprise. In practice this can be as little as being on an investor once per quarter.

? Funds are usually irrevocably committed for a period of five (5) to seven (7) years as either a loan to the new commercial enterprise or as an equity investment.

In this case, the Regional Center is responsible for all the required business planning, as well as regulatory and reporting requirements on behalf of the Investor.

It’s also important to mention that the Investors are not required to fully commit their funds upon filing their visa petition. Nor do investors have to live near the regional center or to be involved in the day-to-day management operations of the project. With this turnkey solution, it is not surprising that over 90% of EB-5 applicants choose to invest under the Regional Center Program.

Additionally, much of the risk of starting a new business, in a foreign country, where the investor may not speak the language or have familiarity with the business practices is mitigated.

In terms of popularity, the program has been oversubscribed in recent years with the majority of applicants applying from China (over 85%), however countries such Iran, Brazil, South Korea, Vietnam and Taiwan have also been very active.

Lawful Source of Funds

Perhaps the most important aspect of an investors petition is documenting the lawful source of the investor’s investment funds. The most common reason a petition is denied is due to lack of evidence demonstrating the lawful source and trail of the investor’s funds. It is paramount that the investor work with an experienced EB-5 attorney that is familiar with the common business practices of the investor’s home country in order to be able to demonstrate the lawful source of their funds. Business practices outside of the United States are often very different to the norms of the how business is conducted in the U.S. Being able to explain the circumstances of how the investor created their wealth, without standard U.S. documentation can be challenging but not impossible. In most circumstances tax returns are not available and it is important to work with an experienced EB-5 attorney to gather additional secondary and tertiary evidence that will demonstrate the lawful nature of the investor’s funds.

Another hurdle that often must be overcome is the actual transfer of the investor’s funds to the United States. In many countries, capital export restrictions exist that limit the annual lawful transfer of funds outside of that country. For example, China limits transfers to $50,000 per year and Vietnam $5,000. In Iran and Syria, there is no financial banking relationship with the U.S., in addition to having certain U.S. Treasury economic sanctions prohibiting wire transfers to the U.S. directly from Iran or Syria. Although nationals of all these countries have been able to send out funds exceeding these limits, using methods such as "hawala", they are very difficult to track and it is essential to be able to demonstrate that the funds that were sent are the same funds belonging to the investor. This money trail chain must be unbroken otherwise USCIS may deny the investor’s petition. Again, working with their attorney, the investor must collect the necessary documentation that proves the funds are theirs.

In all cases, the standard of proof employed is that of “reasonable”. That is, would a reasonable person believe that the funds were lawfully obtained by the investor.

The Future of EB-5

At the time of writing this article the Regional Center program has been extended until December 9, 2016. It would be prudent for interested investors that have a desire to immigrate to the U.S. under the EB-5 visa program, to file their petitions prior to that date and secure their visa under the current terms, which are likely to be more favorable that what has been proposed.

The evolution of the program is likely to involve more legislation and oversight to protect the investor’s investments during the pendency of their investment. As well as an increase in the minimum investment.

Here is an overview of the proposed changes to the EB-5 program;

• Increase in the minimum investment threshold from $500,000 to between $750,000 - $800,000 for a targeted employment area; and $1,200,000 for any other area.

• An increase in the number of visas available under the program.

• Reduction in the number of possible targeted employment areas focusing funds more of particular areas of interest set by the Federal government rather that State economic development agencies.

• Site visits to the new commercial enterprise by USCIS agentes

• More stringent reporting by Regional Centers on active projects

In any event, whatever changes are legislated, they are designed to increase the integrity and transparency of the program to safeguard the investors funds. Even with the proposed increase in investment funds, the program is highly competitive in comparison to the global residency programs offered by other countries. By example, Canada, the United Kingdom and Malta, all offer residency programs that require far more investment than that which has been proposed under the EB-5 program, and none can offer the same benefits that an immigrant can enjoy in the United States.

At present there are over a thousand (1000) federally designated regional centers in every U.S. state, offering a myriad of investment options for potential EB-5 investors. California tops the list of regional centers with Florida a close second. With so many options, picking a project can be a daunting task, however with the help of an experienced EB-5 attorney, the investor will be able to navigate these waters and reach their dreams and goals.

___________

*Reza Rahbaran is the managing attorney at Rahbaran & Associates.