The amount of revenue YouTube paid to music labels relative to the number of streams of their content halved last year, translating to potential lost revenue of $755m for the industry, according to new research.

The online video site, which shares advertising revenue from music videos with artists and labels, paid $740m to music rights holders last year — a 15 per cent rise from the prior year, according to Midia Research.

However, at the same time, streams on YouTube and Vevo, a music site controlled by Sony and Universal Music Group, grew 132 per cent to a record 751bn.

This surge in videos streamed halved YouTube’s effective payment rate per stream from $0.002 in 2014 to $0.001 in 2015, Midia said, based on data from the IFPI trade body and YouTube announcements. Had the payout rate remained the same, music labels would have made slightly more than double, $755m on top of the $740m they were paid, the research showed.

An executive from one large record label said the effective rates they receive from YouTube are even lower.

The findings come as the biggest music labels, plagued by years of shrinking album sales, are in a stand-off with YouTube as they look to hammer out new licensing deals.

While Spotify pays music rights holders a minimum per stream regardless of the revenue they earn, YouTube and Vevo pay as a share of revenue, which is subject to the health of a volatile global ad market. As ad inventory prices dropped last year, weighed down by weakness in emerging markets, YouTube’s ad revenue growth slowed even as streaming boomed.

“YouTube is an ad business, first and foremost,” says Mark Mulligan, analyst at Midia Research. “But labels are not used to being paid based on how profitable the company is.” YouTube and Vevo pay music rights holders 55 per cent of music video revenues, while Spotify paid 83 per cent of its 2015 revenue to content holders.

A boom in digital streaming has helped drive the first rise in year-over-year global music revenue in nearly 20 years. But while the streaming business soars, record labels and artists argue they are being short-changed by YouTube, and that the video platform is exploiting copyright law to pay below market rates for the content.

“There’s no doubt [the revenues paid per stream] are plummeting,” says one executive.

YouTube does not disclose yearly ad revenue payments, although a person close to the company said the $740m figure for 2015 is “understated”.

“Thanks to advertising, YouTube has transformed the promotional cost of the music video into a new source of revenue that has generated $3bn for the music industry,” said Robert Kyncl, YouTube’s chief business officer, pointing to the company’s paid-for-subscription service, YouTube Red, as another source of revenue for rights holders.

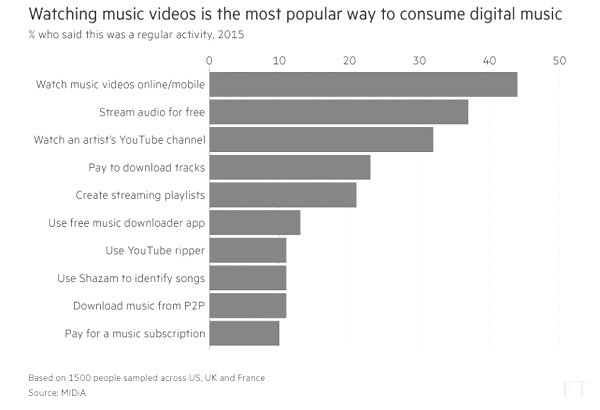

Labels and musicians have hit out at YouTube, which has grown into the world’s biggest streaming music platform, drawing more listeners and viewers than Spotify and Apple music combined.

At issue is the 1998 Digital Millennium Copyright Act, which gives online video services “safe harbour” from prosecution for hosting unauthorised content. Last month stars such as Taylor Swift and Paul McCartney called on the US government to reform the DMCA, alleging that it is outdated and has allowed technology companies to profit at the expense of artists.

Musicians have also complained to the European Commission that YouTube is “unfairly siphoning value” away from artists and songwriters.

“YouTube takes advantage of the dysfunctional DMCA to do less about piracy than it could and pay unfairly low royalty rates,” says Cary Sherman, chief executive of the Recording Industry Association of America. “It doesn’t have to be like this.”

YouTube licenses music from Vevo and has separate deals with Sony Music, Universal Music and Warner Music. YouTube users also upload unlicensed music on the site.

YouTube’s Content ID technology system finds unauthorised videos uploaded by users and gives labels the option of either taking them down or advertising on them. However, the industry alleges that Content ID is letting too many unauthorised videos slip through the cracks. Sony Music said in a filing to the US copyright office that “untold millions in revenue” would “never be realised by Sony due to plays of Sony Recordings that Content ID does not identify”.

YouTube has rejected the labels’ claims and points to what it says is Content ID’s 99.5 per cent success rate in identifying music, with the vast majority of videos left online by choice.

The fight over the DMCA is about power in licensing deals, says Mr Mulligan. Even if the labels refuse to give YouTube licenses for their music, they cannot stop the site’s users from uploading the music illegally, giving the video site more leverage, he says.

One record label executive says that while the odds are slim that the US government would reform the DMCA any time soon, the aim is to pressure YouTube towards concessions with licensing agreements.

“Anything that approaches fair compensation” versus other streaming services would be a win, the executive says.

(Published by Financial Times - July 12, 2016)