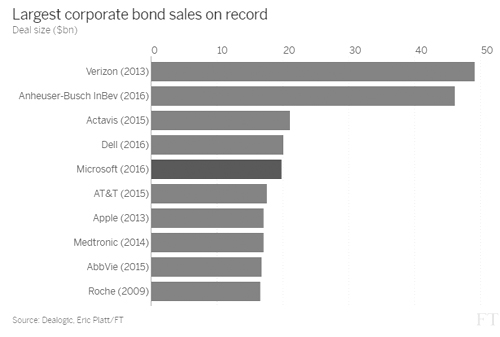

Microsoft jolted fixed income investors to life on Monday when it sold nearly $20bn of debt to fund its takeover of social network LinkedIn, the fifth largest corporate bond sale on record.

Microsoft jolted fixed income investors to life on Monday when it sold nearly $20bn of debt to fund its takeover of social network LinkedIn, the fifth largest corporate bond sale on record.

The sale from the triple-A rated company, one of only two US corporates to hold the opinion from Standard & Poor’s, was met with intense demand as portfolio managers search out income. Trillions of dollars of sovereign and corporate debt are currently trading with a yield below zero.

The US software maker, which agreed to a $26bn acquisition of LinkedIn in June as part of chief executive Satya Nadella’s efforts to revitalise growth, issued $19.75bn of debt with seven maturities, according to three people familiar with the deal.

“It continues to be the basic grab for yield that exists in the world now,” said Chuck Burge, a portfolio manager with Invesco. “We are seeing tremendous interest from overseas. Even domestically you have pension funds and insurance companies that can’t get to their yield targets but have to get as close as they can.”

Fund managers have complained about increasingly tough bond market liquidity, limiting their ability to buy large chunks of bonds in the secondary trading market without distorting the price. New corporate bond sales have in turn offered funds one avenue to reach yield targets.

Order books for the Microsoft sale eclipsed $50bn, the three people said, with demand strongest for 10- and 30-year paper. The sale, which ranks behind offerings from Verizon, Anheuser-Busch InBev, Actavis and Dell, was composed of fixed-rate notes maturing in between three and 40 years.

The transaction included $4bn of 10-year notes, which priced with a yield 90 basis points above the benchmark US Treasury, or roughly 2.42 per cent. New 30-year bonds priced with a yield of 3.73 per cent, 5 bps above existing debt that matures in 2045.

Foreign investors have shifted into the US at a rapid pace as the European Central Bank and the Bank of Japan have cut interest rates into negative territory and stepped up bond-buying programmes.

Strategists with Wells Fargo noted that non-US investors had shown a “clear preference” for investment grade corporate paper, buoying the $73bn of inflows that the asset class has received in the year to date.

“The US investment grade marketplace is one of the last markets to offer any yield,” said Dan Mead, head of Bank of America Merrill Lynch’s US investment grade syndicate. “This is driving investors from around the globe to the US market.”

Jon Duensing, deputy chief investment officer of Amundi Smith Breeden, said that in recent meetings with institutional investors in Asia, income was “very much top of mind and it has been for a while for non-US investors who have been priced out of their local market”.

Microsoft joins a lengthy list of US blue-chip companies taking advantage of record-low borrowing costs.

Investors have clamoured for bonds sold by Apple, Walt Disney, Teva and Verizon over the past month. The sale on Monday will lift US high-grade corporate bond sales for the year above the $500bn mark, ranking behind only the levels of 2015, Dealogic data shows.

The sale will also buoy a limited supply of triple-A rated US corporate debt, of which there is roughly $64bn outstanding, according to Barclays Indices.

Both S&P and Moody’s affirmed their triple-A opinions of Microsoft on Monday despite the significant increase in the company’s debt burden.

Bank of America Merrill Lynch, JPMorgan and Wells Fargo led the underwriting of the sale.

(Published by Financial Times - August 2, 2016)