Obama's $3.8trn budget for the fiscal year

Budget would raise levies on some dividends; GOP dismisses 'campaign document'

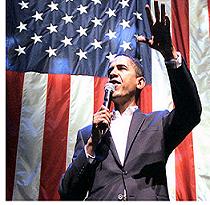

President Barack Obama called on Congress Monday to enact new taxes on the wealthy, restructure the tax code and approve short-term spending measures as part of an election-year budget plan aimed at boosting job growth and helping the middle class.

President Barack Obama called on Congress Monday to enact new taxes on the wealthy, restructure the tax code and approve short-term spending measures as part of an election-year budget plan aimed at boosting job growth and helping the middle class.

Mr. Obama's $3.8trn budget for the fiscal year starting Oct. 1 was quickly dismissed by congressional Republicans and GOP presidential candidates as a political document that fails to seriously tackle the nation's growing debt.

The proposal "isn't really a budget at all; it's a campaign document," Senate Minority Leader Mitch McConnell (R., Ky.) said. "Once again, the president is shirking his responsibility to lead and using this budget to divide."

The budget underscores the White House's bet that it can convince voters in November that increased spending in the short term is needed to jolt the economy before steps are taken to shrink the federal deficit in the long term. "At a time when our economy is growing and creating jobs at a faster clip, we've got to do everything in our power to keep this recovery on track," Mr. Obama said at a community college in northern Virginia.

The budget projects the deficit will exceed $1 trillion in 2012 for the fourth straight year, meaning Mr. Obama won't meet his promise to cut the deficit in half by the end of his first term.

Mr. Obama proposed generating $1.7trn in new revenue over 10 years largely by ending Bush-era tax cuts for families who earn more than $250,000, restoring the estate tax to its 2009 level and limiting subsidies for oil and gas companies.

He also for the first time proposed raising the tax rate households making more than $250,000 a year pay on dividends, from 15% to as much as 39.6%. The White House said the measure would generate $206bn in revenue over 10 years.

Mr. Obama's budget also offered "principles" for future tax reform that included replacing the alternative-minimum tax, a rule adopted to ensure that high-income Americans didn't escape paying taxes. Because it wasn't indexed for inflation, it began ensnaring increasing numbers of middle-class taxpayers, leading Congress to enact a series of temporary fixes.

Mr. Obama, suggested eventually replacing the AMT with a long-term plan named after billionaire investor Warren Buffett. The so-called Buffett Rule would require those who earn more than $1m to pay a tax rate of at least 30% and prevent them from claiming deductions to push their tax rates down.

Mr. Obama offered no details on his preferred path for corporate tax law changes. He is expected to put forward a proposal later this month that would lower tax rates but eliminate or curb many tax deductions, particularly for firms with investments overseas, administration officials said.

The new dividend measure, as well as the overall focus on raising taxes on the wealthy, appeared to take aim at Republican presidential candidate Mitt Romney, whose tax returns show he paid a roughly 14% effective tax rate in 2010. The White House said the plan wasn't targeted at any individual.

Mr. Romney issued a statement Monday criticizing the president's budget for not taking "any meaningful steps toward solving our entitlement crisis."

Congressional Republicans also criticized Mr. Obama for offering no new proposals to reform Medicare, Medicaid or Social Security, which are expanding rapidly as Americans age and health costs climb.

While Mr. Obama's 2013 budget has little chance of becoming law, the priorities it sets out amount to the latest installment of a re-election campaign platform he laid the groundwork for in a December speech in Kansas that called for restoring economic "fairness." Mr. Obama expanded on those themes in his State of the Union address last month and doubled down Monday with policy details in a budget proposal that included pointed attacks on Republicans.

In a shift from his past budgets, and from the one put forward by George W. Bush the year he was up for re-election, Mr. Obama repeatedly criticized Republicans. He blamed Congress's failure to pass the jobs measures he proposed last September and his deficit-reduction plan on the "unwillingness by Republicans in Congress to ask the wealthiest among us to pay their fair share through any revenue increases."

Although Republicans attacked Mr. Obama's budget, there were signs Monday that the White House is gaining some ground on the president's agenda. House Republican leaders signaled they were prepared to allow an extension of the payroll tax cut—a top White House priority—without demanding spending cuts in return. The move marks a second retreat by Republicans on the payroll-tax issue in recent months.

Mr. Obama's budget fills in the details of how he prefers to meet 2013 caps in "discretionary" spending—the spending that is approved annually by Congress—that were set in an agreement the White House and congressional Republicans reached last summer.

At the same time, he proposed a number of new programs that the White House describes as "mandatory" spending, which wouldn't be subject to the caps. These included $2.7bn for a new community college program, $1.8bn to make homes more energy efficient and $6 billion to modernize schools.

White House officials said the president's budget would reduce the deficit by $3trn over 10 years through a combination of the new taxes, modest changes to health-care programs such as Medicare and Medicaid and other spending cuts.

That would be in addition to a $1trn deficit-reduction agreement they reached with Republicans last year, which capped future spending on a range of annually appropriated programs.

Mr. Obama's proposed spending cuts touch agencies across the federal government. They include reducing mail delivery by the U.S. Post Office to five days a week, giving the Treasury Department the authority to rethink the way pennies and nickels are coined to save costs and new restraints on military veteran benefits.

Still, the proposal projects Mr. Obama will miss his initial deficit-reduction targets. Instead of bringing the deficit under control by 2014, as the White House had planned, the administration now says significant reductions won't take place until 2018.

In addition to cuts, the budget includes $137bn in spending proposals designed to spur economic growth by funding education and transportation projects. It also proposes continuing through December a tax break for businesses to encourage investment.

The budget would boost spending in some areas that fit with Mr. Obama's political agenda. He proposes increases for the Securities and Exchange Commission and the Commodity Futures Trading Commission, two financial regulators that have come under fire after recent Wall Street mishaps. Mr. Obama also proposed $26m for a new Interagency Trade Enforcement Center, which he created to challenge unfair trade practices around the world but is mainly targeted at China.

"The budget that we're releasing today is a reflection of shared responsibility," Mr. Obama said in his remarks in Virginia on Monday. "And some people go around; they say, 'Well, the president is engaging in class warfare.' That's not class warfare; that's common sense."

(Published by WSJ - February 14, 2012)