Case Study: Brazilian Thin Capitalisation Rules

Lucas Kurtz, Daniel Takaki and Joaquim Manhães Moreira *

Introduction

The purpose of this case study is to provide the reader with a better understanding of Brazil's new thin capitalisation ("Thin Cap Rules") rules. The case study analyzes the use of intercompany loan(s) to finance construction of a Brazilian factory and provides diagrams illustrating the consequences associated with various corporate structures and sources of capital.

Overview of Brazilian Thin Capitalisation Rules

Following similar trends in other countries, such as the United States, the United Kingdom, Australia and Argentina, the Brazilian regulation attempts to discourage thin capitalisation and incentivise pure capital increases.

A company is said to be "thinly capitalized" when it has a high proportion of debt in relation to its equity. Thin Cap principles dictate the debt and corresponding interest eligible for the borrower’s corporate income tax deduction. By complying with the Thin Cap thresholds, borrowing subsidiaries can classify payments to the “related party lender” as payments of interest, which are eligible for an income tax deduction not available for dividend payments. However, when the loan exceeds the applicable Thin Cap debt limit, only the amount of interest paid proportional to the debt limit amount will be eligible for the Brazilian corporate income tax deduction.

Financial Transaction Tax

During March 2012, in an effort to manage the inflow of foreign capital and prevent appreciation of the Brazilian Real, the Brazilian government increased financial transaction taxes (“IOF”) applicable to cross-border loans. Here, rate increases made during March 2011 were extended to apply to loans with longer repayment terms.

Under the new policy, cross-border loans with a payment period of 1,800 days or less (approximately 5 years) will now be taxed at a rate of 6%. This change and increase is significant. The previous IOF tax rate for loans with repayment term between 321 - 1,800 days was a meager 0.38%. The new rate applies to nearly all loans and lines of credit issued by foreign banks and companies, including intercompany loans.

Facts

UK HiTech is a United Kingdom company with several international subsidiaries and independent resale partners. For years UK HiTech has used a Brazilian subsidiary to distribute machinery and software to end users in the Brazilian automotive and construction industries. In addition to its Brazilian subsidiary, UK HiTech has subsidiaries in the United States of America, Canada and the Cayman Islands.

Five years ago the total amount of initial capital used to form HiTech Brazil was $1.0 million. Today, the net worth of HiTech Brazil is $1.5 million.

After the Brazilian government approved three new policies in August 20111, UK HiTech decided to build a factory in Brazil’s Northeast region. Construction of the factory will be financed by intercompany loan(s) totaling $1.8 million.

Now, company executives must examine Brazil’s Thin Cap rules in order to effectively evaluate several options pertaining to (1) corporate structure; and (2) which existing entity(ies) will finance construction of the Brazilian factory.

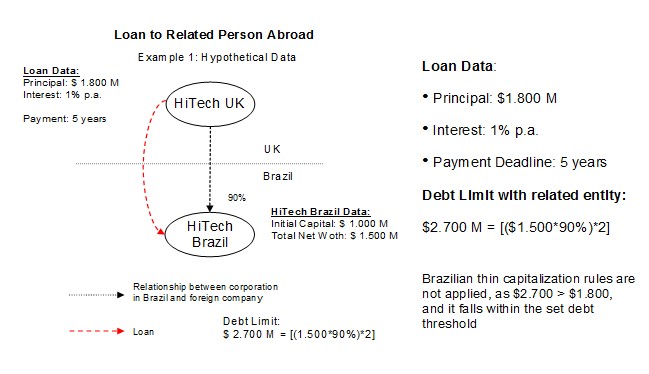

Scenario 1: 100% of Financing provided by Direct Equity Interest Holder

Facts:

Applicable Rule:

If the lending related party directly holds an equity interest in the borrower, then the debt limit amounts to twice the related party's equity interest.

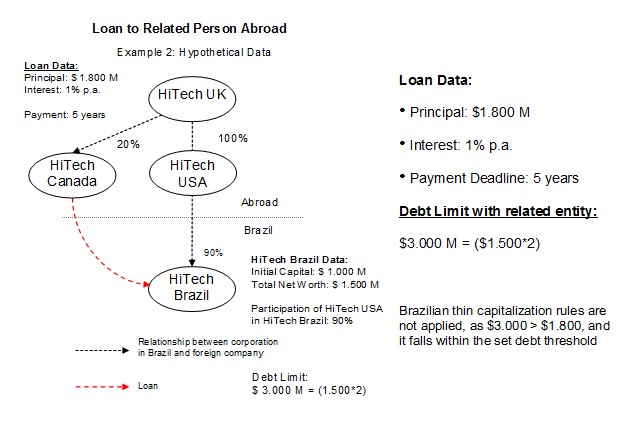

Scenario 2: 100% of Financing provided by an Indirect Equity Interest Holder

Facts:

-

HiTech USA holds a 90% direct equity interest in HiTech Brazil

-

HiTech Canada does not hold a direct equity interest in HiTech Brazil

-

HiTech Canada will lend $1.8 million to finance construction

Applicable Rule:

If the lending related party does not directly hold an equity interest in the borrower, then the debt limit is twice the borrower's net worth.

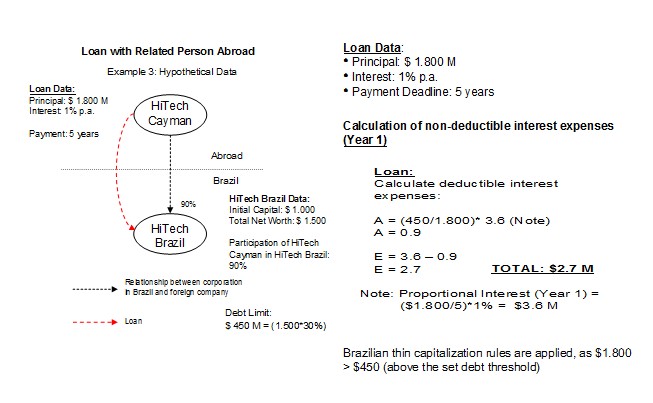

Scenario 3: Financing provided by a Related Party Located in a Privileged Tax Regime

Facts:

Applicable Rule:

If the lending related party is located in a privileged tax regime, then the debt limit is equivalent to 30% of the borrower's net worth.

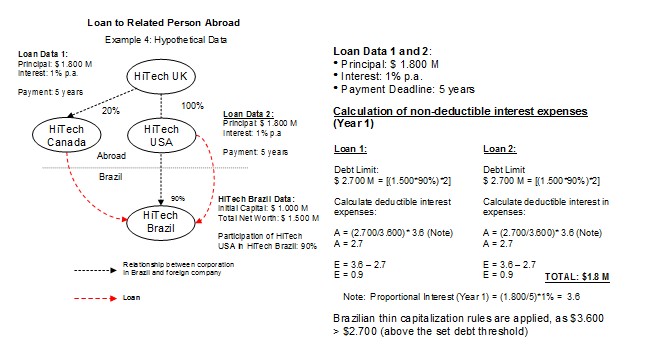

Scenario 4: Financing provided by a Direct and Indirect Equity Interest Holder

Facts:

-

HiTech USA holds a 90% direct equity interest in HiTech Brazil

-

HiTech Canada does not hold a direct equity interest in HiTech Brazil

-

HiTech USA and HiTech Canada will in total lend $1.8 million to finance construction

Applicable Rule:

If loans are granted by a group of related parties, some of which hold a direct equity interest in the borrower and others of which hold no such interest, then the debt limit is twice the sum of the equity interest held by the group as a whole.

Summary

Corporate structure, origin of funds and ownership of entities all trigger different tax consequences2. Only after analyzing the Thin Cap rules, other tax implications and important business factors can executives and their advisors be confident that they are capitalising the Brazilian entity in the most effective manner.

_____________

1 (1) Corporate income tax exemption or a 75% reduction thereof for equipment manufacturers in Brazil's north & northeast region; (2) New payroll tax deduction for software manufacturers; and (3) New advantages, pertaining to public procurement, for products manufactured in Brazil.

2 Double tax treaties are another important factor that should be analyzed when sending capital to a Brazilian entity.

______________

* Joaquim Manhães Moreira, Daniel Takaki and Lucas Kurtz are lawyers at Manhães Moreira Advogados Associados.